Introduction

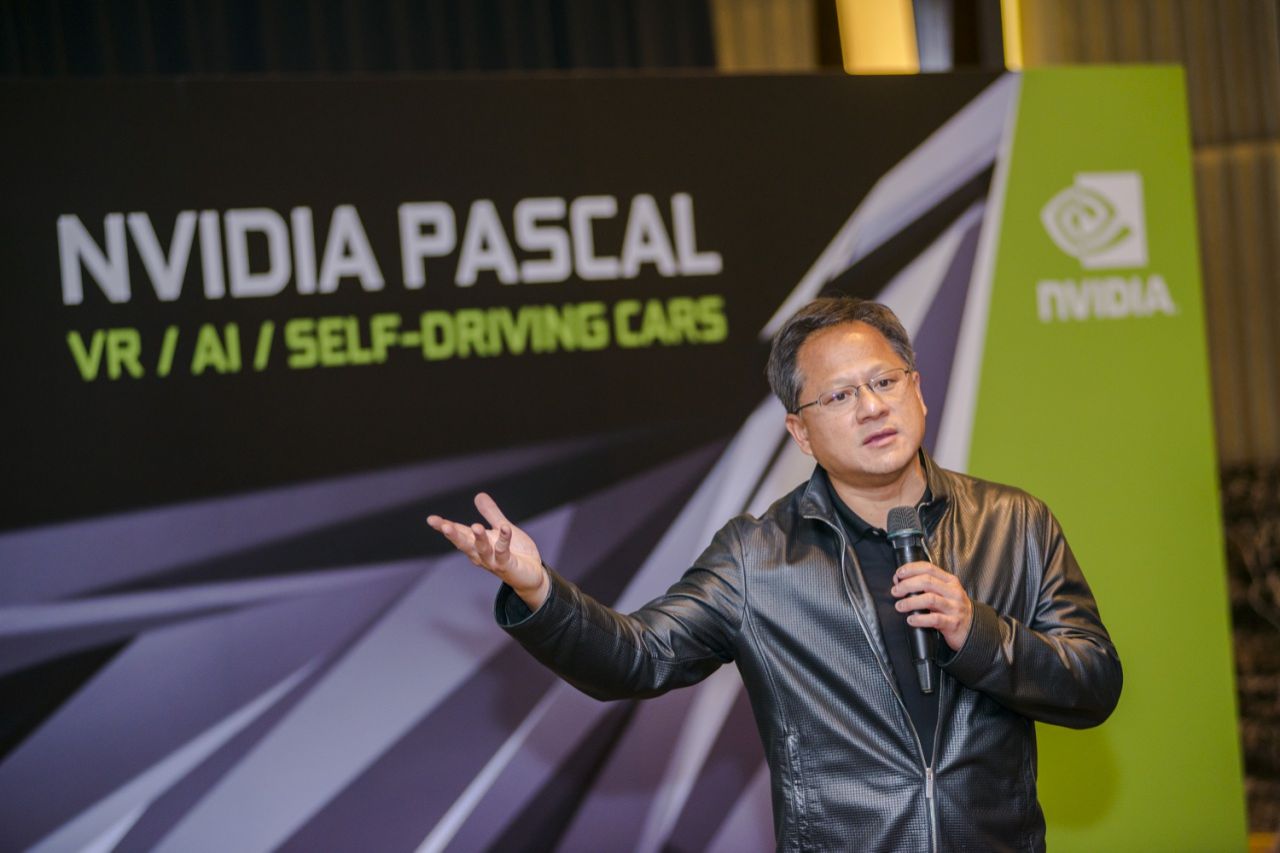

During a private dinner in Taipei, Nvidia CEO Jensen Huang revealed a startling fact: China has approximately one million professionals working on artificial intelligence, compared to just 20,000 in the United States. This statement, leaked despite the event's confidential nature, has shaken the global technology sector and raised questions about the real effectiveness of American export control policies.

The AI talent gap between China and the US represents a 50-to-1 ratio, highlighting how restrictions imposed by Washington may be producing counterproductive effects compared to stated objectives.

The Context of the Private Taipei Dinner

In early November 2025, Jensen Huang gathered a dozen of Taiwan's most powerful technology leaders at the Grand Hyatt in Taipei. The meeting, intended as off-the-record, aimed to discuss the evolution of the semiconductor and artificial intelligence sector in Asia. However, the CEO's statements quickly leaked through three attendees who shared details with the Financial Times.

During the dinner, Huang didn't limit himself to comparing AI workforce numbers. He launched a scathing critique of the American semiconductor export control strategy, arguing that Washington is achieving exactly the opposite of what it intends. According to his words as reported by those present, "Washington thinks they're stopping China. They're not stopping China — they're accelerating China."

The Boomerang Effect of US Sanctions

Since 2022, when the Biden administration first imposed sweeping restrictions on advanced chip exports to China, Nvidia's China revenue has collapsed. From $17 billion, representing 13% of total sales, it has fallen to near-zero for the most advanced products. The company recorded $5.5 billion in charges related to halted H20 chip shipments, with total losses estimated by Huang at $15 billion.

Instead of crippling China's AI development, the sanctions appear to have triggered what Huang describes as a "national mobilization." Research data released in July 2025 shows China's AI workforce expanded from fewer than 10,000 people in 2015 to 52,000 by 2024. Even more significant: China now hosts over 30,000 active AI researchers—a combined PhD and postdoctoral base that is double the size of the entire US AI research population.

The Research System Comparison

While China fields an army of mostly young researchers spread across 156 institutions that each published more than 50 AI papers in 2024, the United States had just 37 such institutions. The US AI engineering workforce, concentrated heavily in Silicon Valley and Seattle, numbers between 30,000 and 50,000 people total—a fraction of China's full-time AI workforce when counting researchers, engineers, and industry practitioners.

The Huawei Factor and the Rise of Domestic Chips

Among Huang's most provocative claims, according to dinner attendees, was his assessment of Huawei's progress in developing alternatives to Nvidia's chips. He allegedly stated that Huawei's Ascend 910C processor had nearly matched Nvidia's performance, lagging by just 8-12%, with monthly production reaching 200,000 units.

The reality is more nuanced. Independent testing by researchers at DeepSeek found the Ascend 910C achieving approximately 60% of Nvidia's H100 performance on inference tasks—a significant gap, but far from technological irrelevance. Production figures tell a more complex story: industry analysis from SemiAnalysis projects Huawei shipping 805,000 Ascend units in 2025, of which 653,000 are the more advanced 910C model.

Stockpiling Strategy and Local Production

What makes these numbers remarkable is their trajectory rather than their absolute scale. Huawei initially relied on a "die bank" of chips manufactured by Taiwan's TSMC before export controls fully took effect, circumventing restrictions to stockpile over 2.9 million dies. As this stockpile depletes, China's Semiconductor Manufacturing International Corporation (SMIC) has ramped production using an enhanced 7-nanometer process—less advanced than TSMC's 4nm nodes used by Nvidia, but sufficient for meaningful volumes.

By 2026, Huawei plans to manufacture 600,000 Ascend 910C units, with total Ascend line production reaching 1.6 million dies. The bottleneck is shifting from chip fabrication to advanced memory: China's CXMT can currently produce only about 2 million stacks of high-bandwidth memory annually, enough for 250,000 to 300,000 high-end AI chips. But that capacity is growing.

The Critical Forecast: 2027 as Inflection Point

Perhaps Huang's most alarming prediction for US policymakers was his assessment of computing power. "By 2027, China will have more AI compute than the rest of the world combined," he reportedly told the Taipei gathering.

Chinese government data lends some credence to this forecast. China's intelligent computing power reached 260 EFLOPS in 2022 and is projected to hit 1,117 EFLOPS by 2027—a compound annual growth rate of 33.9%. Domestic AI chip market share in China surged from 28% in 2022 to 65% in 2025, with Huawei's Ascend ecosystem commanding 40%.

Policy Mandates and Government Incentives

Meanwhile, policy mandates are accelerating localization. Beijing targets 100% self-developed intelligent computing infrastructure by 2027, while Shanghai requires more than 50% domestic chips in new AI data centers by 2025. These aren't aspirational goals—they're backed by substantial subsidies, including Hangzhou's 250 million yuan annual "computing power vouchers" to subsidize cloud adoption.

The Public Walk-Back and Difficult Balance

Huang's dinner comments remained private for barely 48 hours. On November 5, speaking publicly at the Financial Times' Future of AI Summit, he told reporters: "China is going to win the AI race." The statement triggered immediate market jitters and diplomatic discomfort.

Within hours, Huang issued a clarification on social media platform X: "As I have long said, China is nanoseconds behind America in AI. It's vital that America wins by racing ahead and winning developers worldwide."

The swift reversal exposed the tightrope Huang walks. As head of the world's most valuable semiconductor company—market capitalization exceeding $5 trillion—he must navigate competing pressures: shareholders alarmed at lost Chinese revenue, US officials enforcing national security priorities, and Asian manufacturing partners caught in the middle.

A Pattern of Public Criticism

Yet his pattern of public criticism suggests more than diplomatic missteps. In May, before the annual Computex exhibition in Taipei, Huang told journalists that US export control policy was "fundamentally wrong" and noted that "50% of global AI researchers are Chinese." Days later at Computex, he stated bluntly that "American AI chip export controls to China have failed."

The Strategic Paradox of Technological Bifurcation

Huang's leaked remarks crystallize a paradox that has troubled some economists and technology strategists. Brookings Institution research published in August argued that "starving China's supply of US-designed AI chips will have the opposite effect, as it will push China to more effectively develop and deploy its own AI chip capacity and ecosystem."

The evidence increasingly supports this concern. China's development of DeepSeek—a cost-efficient, open-source AI model released in early 2025 under an MIT license—demonstrated the country's ability to achieve competitive results without access to cutting-edge American hardware. The model's emergence shocked US technology markets and accelerated AI development within China.

The Reversal of Talent Flows

Rather than creating dependence, the export controls appear to have severed one of America's strongest points of leverage: the integration of Chinese AI development into US-dominated supply chains and ecosystems. Where Chinese tech companies once relied on Nvidia's CUDA software platform and its vast developer community, they're now building entirely parallel infrastructures.

China is also reversing historical talent flows. The country has become a net gainer of AI researchers from nations including the US and UK, inverting earlier patterns of brain drain. Major American companies maintain substantial AI teams in China: Microsoft deployed 714 AI researchers there, representing 29% of its global total, while Chinese firms Tencent and Alibaba host 94.6% and 90.2% of their AI teams domestically.

The Unspoken Implications and the Future

What Huang left unsaid may be as important as his warnings. Nvidia's business model depends on ubiquitous adoption of its chips and software ecosystem. Every AI researcher trained on competitor platforms, every data center built around alternative architectures, represents not just lost current revenue but diminished future market position.

The export controls have created the conditions for a bifurcated global AI infrastructure—one using Nvidia and other American chips, another using Chinese alternatives. For a company that once held 95% of China's AI chip market and has seen that share halve to approximately 50%, this represents an existential threat disguised as a geopolitical strategy.

Two days after his Taipei dinner leaked, Huang appeared in Tainan, Taiwan, to dismiss speculation about resumed Chinese sales. "There are no active discussions" about selling Nvidia's next-generation Blackwell chips to China, he said, while adding hopefully that he wanted to "serve the Chinese market again in the future."

"You want to sanction? Go ahead and sanction. You're handing them the trophy with your own hands."

Jensen Huang, Nvidia CEO

Conclusion

The revelations from the private Taipei dinner have exposed an uncomfortable reality: American technology sanctions may be accelerating, rather than slowing, China's AI independence. The 50:1 talent gap, explosive growth in Chinese computing capacity, and the emergence of competitive alternatives to Nvidia chips suggest that the containment strategy may produce far-reaching unintended consequences. Whether Huang's prophecy proves accurate may not be known until 2027—or perhaps, as he might argue, nanoseconds sooner.

FAQ

How many AI workers does China have compared to the United States?

According to Nvidia's Jensen Huang, China has approximately one million professionals working on artificial intelligence 24/7, while the US has about 20,000 in Silicon Valley, creating a 50-to-1 gap.

Are US AI chip sanctions working against China?

According to Huang's analysis and industry data, the sanctions are producing the opposite effect, accelerating the development of Chinese domestic alternatives and national AI resource mobilization.

What are Huawei's Ascend chips and how do they compare to Nvidia?

Huawei's Ascend 910C chips achieve approximately 60% of Nvidia's H100 performance in inference testing, with projected production of 805,000 units in 2025.

When could China surpass the US in AI computing capacity?

Jensen Huang predicts that by 2027 China will have more AI compute than the rest of the world combined, supported by government projections of 1,117 EFLOPS.

Can Nvidia still sell advanced AI chips to China?

No, US export controls prohibit the sale of Nvidia's advanced AI chips to China, costing the company approximately $15 billion in lost sales since 2022.

How many AI researchers does China have versus the US?

China hosts over 30,000 active AI researchers (PhD and postdoctoral), double the entire US AI research population, distributed across 156 major institutions.