Introduction

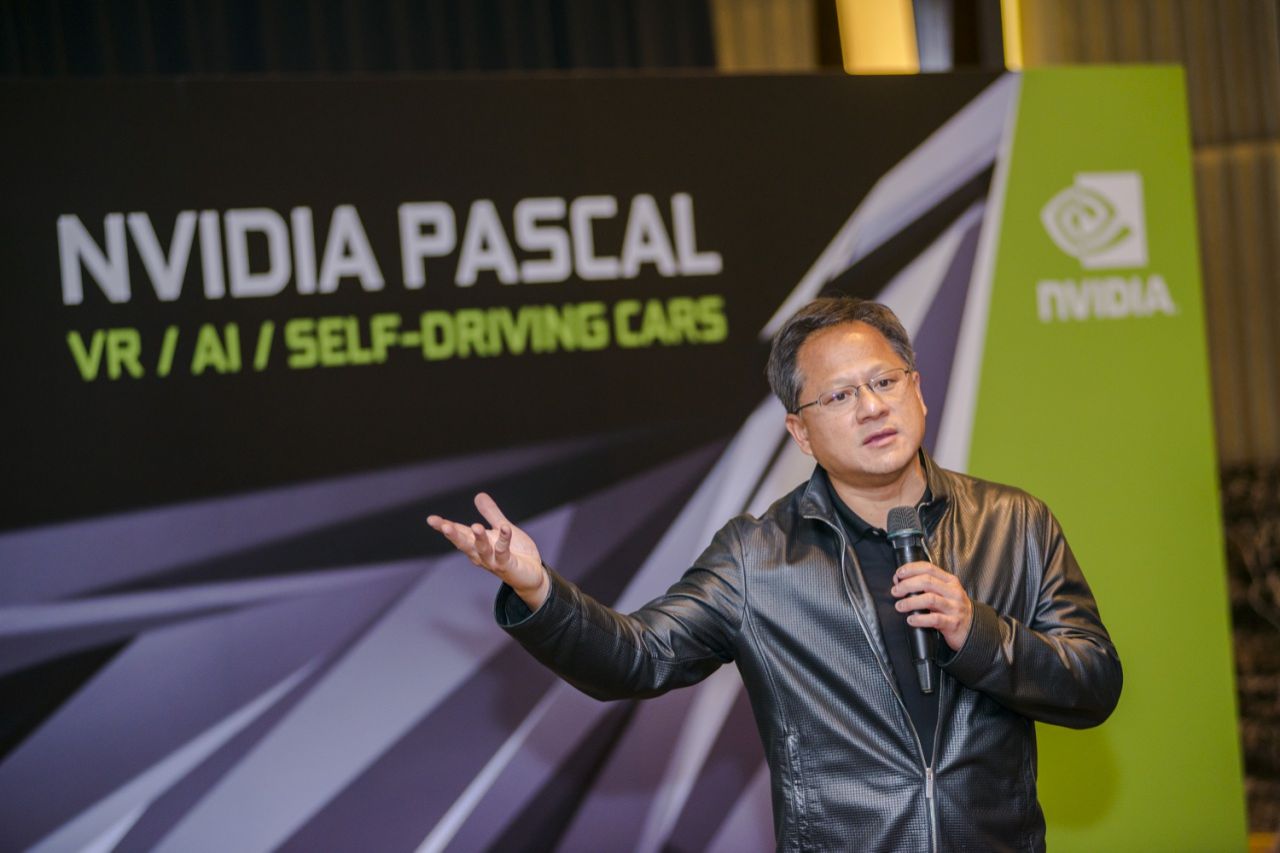

Nvidia has announced a complete exit from China's advanced AI accelerator GPU market, with its market share collapsing from 95% to 0%. CEO Jensen Huang revealed this shocking figure on October 6 during a Citadel Securities event in New York, stating: "At the moment, we are 100% out of China." The move represents a watershed geopolitical moment in artificial intelligence development, where American technological control has overridden traditional global commercial logic.

The context of US sanctions

Nvidia's China retreat is not sudden but the result of successive waves of trade restrictions beginning in October 2022. The United States has progressively blocked the export of advanced semiconductors to Beijing to slow China's AI development. Nvidia's datacenter GPU product line—symbols of American technological supremacy—became the primary target.

From A800/H800 chips to H20 failure

Nvidia attempted multiple workarounds. In 2023, the A800 and H800 chips, specifically designed for the Chinese market, were declared non-compliant with export regulations. Later, the company launched the H20, a "toned-down" version meant to bypass controls. This approach also failed: the new chip faced "licensing hurdles" that rendered it essentially unusable. Huang did not specify which products fall under current bans, but indicators clearly point to the entire datacenter GPU line.

Economic impact: 20–25% revenue loss

Losing China carries significant financial consequences. According to Huang, the Chinese market represented 20–25% of Nvidia's datacenter revenue before the collapse. A publicly traded company like Nvidia, dependent on quarterly growth, cannot afford to ignore a segment of this magnitude. For this reason, the company decided to completely exclude China from revenue forecasts—an official admission that near-term comeback prospects are zero.

Jensen Huang's criticism of policy

Huang expressed frustration at American policymakers: "I can't imagine any policymaker thinking that's a good idea, that whatever policy we implemented caused America to lose one of the largest markets in the world to 0%." The comment reveals internal tension: on one hand Nvidia remains tied to US national security interests; on the other, the CEO acknowledges that the ban might fuel the emergence of non-American competitors in China's AI chip sector.

Geopolitical and competitive implications

The void left by Nvidia could be filled by Chinese manufacturers or alternative technology alliances. Total American control over advanced AI chip exports represents a powerful geopolitical weapon but carries side effects: it slows global AI adoption, destabilizes worldwide supply chains, and accelerates the search for independent solutions across Asia. For the international technology sector, Nvidia's China collapse signals that political constraints now override traditional market dynamics.

Conclusion

Nvidia's shift from undisputed leader (95% share) to total absence (0%) in China's AI GPU market represents one of the most significant geo-economic fractures in recent history. US export controls achieved the goal of containing American technology in China, but at the cost of ceding an entire global market segment. Jensen Huang, though critical, has normalized this new reality: Nvidia no longer counts China in revenue and is redesigning strategy around alternative markets. The data remains emblematic of how technology is now inseparable from geopolitical tensions.

FAQ

When did Nvidia's collapse in the Chinese market begin?

American export restrictions on AI GPUs began in October 2022. Nvidia progressively lost market share until the complete collapse was declared in 2025.

Which Nvidia GPUs were banned in China?

The A800 and H800 chips were rendered non-compliant in 2023. Subsequently, the H20, developed to circumvent bans, also faced insurmountable licensing obstacles.

How much did China represent in Nvidia's revenue?

The Chinese market accounted for 20–25% of Nvidia's datacenter revenue before collapse, a significant loss now excluded from financial forecasts.

Why did the US block AI GPU sales to China?

Export controls aim to slow China's artificial intelligence development for national security reasons and American technological supremacy globally.

Does Jensen Huang criticize the sanctions?

Yes, Huang stated that restrictions caused the US to lose one of the world's largest markets, expressing frustration toward policymakers.

Who could replace Nvidia in China?

Local Chinese manufacturers or regional technology alliances could fill the void left by Nvidia, accelerating independent AI chip development.

Will Nvidia ever return to China?

Currently no return is planned, as Nvidia has completely excluded China from revenue forecasts and restrictions remain in force.

What are the global consequences of Nvidia's China exit?

The collapse weakens worldwide supply chains, slows global AI adoption, and demonstrates how geopolitical tensions now override traditional market dynamics.